CNI News

4 January 2025

Because the bank concerned was responsible for the security system regarding the mobile phone digital money fraud, the bank must solve the fraud problems, banking experts and businessmen told CNI News.

The frauds were not because of users and data of the users could be hacked by the bank only, U Htay Aung Kyi, a banking expert, told CNI News.

" There are three points. There are passwords in the data transition. Two are related to customers and one is related to the bank. According to Information Technology, if you hack the information about the customer, you can't reach the information about the bank. But if you hack the information regarding the bank, you'll know the passwords and information about the customers. In any case, the bank is responsible for the security system in mobile banking. Management Information Systems (MIS) must be applied carefully for security. But we can't find any accountability when the problem takes place. In my opinion, bank staff must be inspected. Mainly, the bank is responsible for the security system." he said.

While seeing a shop providing digital money service

The users of the KBZ Pay, digital mobile money of the Kanbawza Bank, were embezzled after being said by phone that the KBZ Pay would be upgraded in the past. But now money is being widely stolen by using technology.

The Central Bank announced on December 31 that it is identifying individuals and organizations that commit digital financial fraud through mobile phones and will take effective action.

Frauds were not because of users and fraud cases through one time passwords, passwords and security data reportedly are being investigated.

The people were using digital mobile money because they didn't trust banks and because the bank was not responsible and accountable in the fraud cases, the credibility of the bank declined more, U Aung Pyae Sone, a businessman, told CNI News.

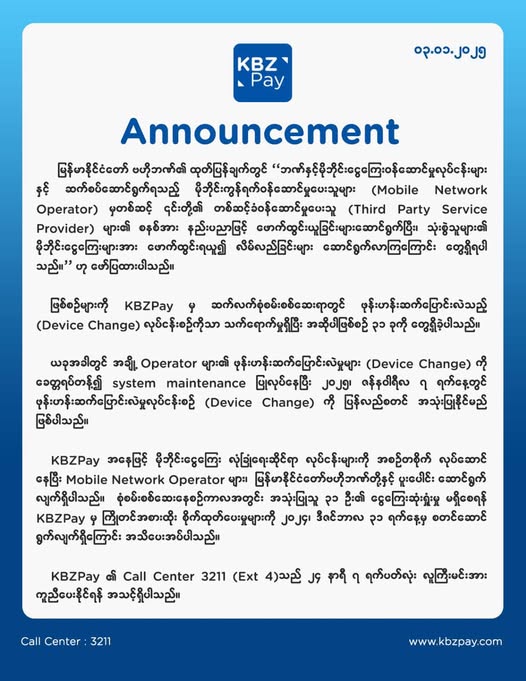

While seeing the statement released by the KBZ Pay

" The bank or the mobile operator must find an answer as to why it happened. They must have responsibility and accountability. Otherwise, the people are not to use it. The money that was deposited in a way that was thought to be safe and easy to use has disappeared, and there are questions about who will take responsibility and take action. Officials concerned will have to take responsibility." he said.

When the KBZ Pay investigated fraud cases, they were related to the device change such as change of handsets and 31 cases were identified, reported the KBZ Pay on 3rd January 2025.

Now the device change has been suspended by operators and the system maintenance is being conducted.

On 7th January 2025, the device change can be started again.

While investigating, the KBZ Pay has started advance replacement payments since 31st December so as to prevent financial loss for 31 users.